Fraud Rules Engine

PREVENT FRAUD IN REAL TIME

with Fraud Rules Engine from Neural Payments

How do we help financial institutions mitigate risk and reduce fraud in the growing P2P space?

Both fraud and mistakes in sending P2P payments create headaches and losses for financial institutions and consumers. The key to making P2P safer is to halt fraudulent activity before it happens. We stop P2P fraud in its tracks with Fraud Rules Engine, a proprietary, revolutionary technology that leverages real-time automation to lock down, evaluate and respond to suspected transactions.

CUSTOMIZE RULES

for specific trigger events

SPECIFY THE RESPONSE

with corresponding actions

IDENTIFY FRAUD

based on customized rules

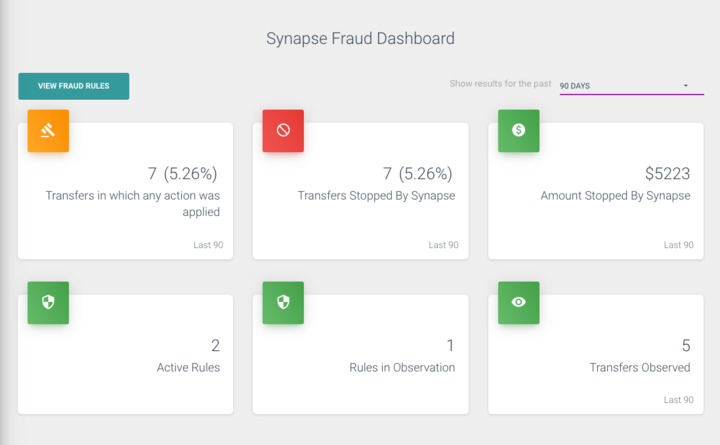

TEST, ENABLE, AND MANAGE RULES

on the Fraud Rules Engine dashboard

Your financial institution can customize transaction triggers based on amounts, velocity within a specified period, first-time senders, an exclusion list of known bad actors, and inactive senders. You can customize the response by failing the transfer, lowering limits, suspending or blocking users, or notifying the financial institution – or all of the above.

Fraud Rules Engine integrates with our embedded P2P solution in your digital banking experience. Together, these technologies keep your consumers safer while sending money and more engaged with you.