Offering Financial Institutions Secure, Instant Payments for Anyone, Anywhere

Neural Payments has created a best in class payments hub that offers Financial Institutions everything from peer to peer (P2P) payments to disbursements for small business (SMB) customers, all from a single integration. Discover how we're changing FIs options for payments solutions today.

%20(1).png)

P2P Payments

Instant P2P Payments

Our cutting-edge technology that enables financial institutions to facilitate seamless peer-to-peer (P2P) transactions.

-

Pay Anyone, Anywhere

-

Integrates With Your Mobile Banking App

-

Go Live In As Little As 90 Days

Disbursements

Small Business Payments

Disbursements allows small businesses and individuals the ability to send single and bulk payments from a simple file upload.

-

Pay Multiple Recipients At Once

-

Tailored For SMB Needs

-

Built On Our Powerful Payments Engine

Fraud Engine

Protect Your Customers

Fraud Rules Engine integrates with our embedded P2P solution in your digital banking experience.

-

Fully Customizable

-

Included With All Products

-

Support From Fraud Specialists

Why Customers Love Our Top Rated Payments Solution

"Highly knowledgeable staff dedicated to ensuring high quality solution."

"They were amazing to work with and they were very open to our suggestions and trying to help us bring the vision we had to market."

"Thank you for listening to your partners, hearing our feedback, and taking action."

Payments Technology for Financial Institutions of All Sizes

Go Live In As Little As 90 Days

Experience seamless integration and go live in as little as 90 days. Accelerate your digital payments strategy with a solution designed to meet your needs faster than competitors.

Lower Customer Acquisition Costs

Reduce costs while enhancing your value proposition. With our “recipient first” approach, anyone receiving funds outside of your Financial Institution becomes a potential customer.

Build Digital Banking That Fits Your Customers

Customize our P2P and SMB solutions to match your FI's brand. With Neural Payments, you get a white-labeled, flexible solution that integrates seamlessly into your ecosystem.

Limit Fraud Exposure

Protect your customers and your reputation. Our advanced fraud engine minimizes risks with customizable rules, helping you safeguard transactions in real time.

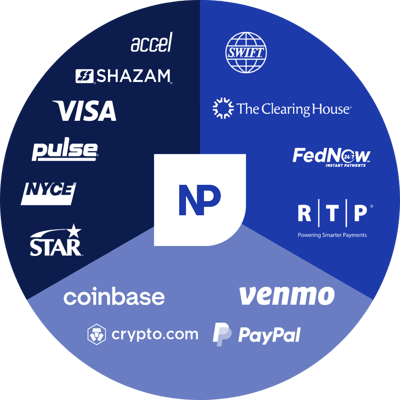

What Is A Payments Hub, Anyway?

Time and again FinTechs have promised to create a truly unified payments hub, connecting all major payment networks through a single point of integration for you financial institution. In most cases, all they've done is put a wrapper on legacy systems. Learn how we've created an industry leading solution for your FI - what we call the Neural Payments Hub - that unifies all payment rails. This allows your banks or credit union to seamlessly transfer funds via traditional rails, digital wallets and API based payment technology.

The Importance of P2P Payments for Fintechs

A study published by PYMNTS reports that consumers want fintechs to make money mobility a top priority—sending and receiving money through instant transfers is a top desire for them.

The Power of Branding Transactions

In the world of finance, it's a well-known fact that money comes and goes. So, why not make the most of it while it's in your hands?

Fighting Check Fraud

Risks to the consumers and businesses that use paper checks have never been higher. Despite these risks, checks are still commonly used among consumers, and as much as 42% of all B2B transactions are still made by paper checks.

Offer Your Customers and Members the Best Experience Possible

Having trouble finding the right fit for your FI? Our free ebook on aligning your institution's digital banking solution with available payments tools will help cut through the noise.

Want to know more?

What Is a Payments Engine?

A payments engine is the core technology that enables the seamless movement of money between senders and recipients. Neural Payments' engine goes beyond simple transactions, providing a fast, secure, and flexible platform that integrates seamlessly with your financial institution’s digital systems. It empowers users to send payments instantly to any bank account, debit card, or popular fintech wallet, giving recipients the freedom to choose how they receive funds—no need for a shared app or platform.

With Neural Payments, you’re not just processing payments; you’re delivering a modern, customer-focused experience that enhances trust and satisfaction.

How Does Your Fraud Rules Engine Work?

Neural Payments' advanced fraud rule engine combines real-time monitoring, machine learning, and customizable rules to minimize fraudulent activity while ensuring smooth payment processing. Here's how it works:

- Real-Time Detection: Transactions are analyzed instantly to detect unusual patterns, such as abnormal amounts or suspicious accounts.

- Customizable Rules: Your financial institution can tailor fraud rules to match your risk tolerance, ensuring maximum protection with minimal disruption.

- Proactive Updates: Our engine continuously learns and adapts to emerging fraud threats, keeping your institution one step ahead.

The result? A safer payments experience for you and your customers without sacrificing speed or convenience.

Who Can Receive Payments?

With Neural Payments, anyone can receive payments, regardless of their financial institution or preferred platform. Recipients have the flexibility to choose where they’d like the funds to go:

- Directly to their bank account.

- Onto a debit card.

- Into a digital wallet, such as Venmo or PayPal.

This universal reach makes Neural Payments a standout solution, offering freedom and convenience to your customers while eliminating barriers for recipients.

What Payments Networks Do You Integrate With?

Neural Payments integrates with a broad range of payment networks to ensure flexibility and reliability for financial institutions and their customers. Our platform connects seamlessly with:

- ACH and RTP rails for traditional and real-time payments.

- FedNow for instant transactions.

- Popular digital wallets like PayPal and Venmo.

- Debit card networks for secure and rapid fund transfers.

By bridging these networks, we enable your customers to send payments to virtually any endpoint, delivering the most comprehensive payment options in the market.

How Is Neural Payments Different from Zelle or Payrailz?

Neural Payments offers a unique alternative to Zelle and Payrailz by addressing common challenges financial institutions face with these platforms:

- Flexibility: Neural Payments allows customers to send payments to anyone—no shared app or bank account required.

- Enhanced Security: Our fraud prevention engine detects and blocks fraudulent activities in real-time, and allows for direct input and adjustment from your organization.

- Ease of Integration: Neural Payments integrates seamlessly into your existing digital banking platform, ensuring quick deployment and a consistent customer experience.

- White-Labeled Customization: We elevate your institution’s brand with a fully white-labeled solution, unlike Zelle’s co-branded approach.

By combining flexibility, security, and user-focused design, Neural Payments empowers financial institutions to deliver superior payment experiences.

What Types of FIs Benefit Most from Neural Payments?

Neural Payments is designed to serve a wide range of financial institutions:

- Community Banks and Credit Unions: Modernize digital offerings and compete effectively with larger banks.

- Mid-Sized Banks: Address concerns like fraud reduction and provide real-time payments for enhanced customer satisfaction.

- Large Financial Institutions: Our payments engine scales seamlessly within complex systems and we can customize offerings to deliver advanced payment solutions.

- Non-Traditional Providers: Support diverse use cases, including account funding and disbursements, for fintechs and alternative financial institutions.

Whether you’re a small community bank or a large financial institution, Neural Payments equips you with the tools to thrive in a competitive payments landscape.

Let's stay in touch. Get notified of new products, events and payments industry trends from Neural Payments

Be the first to know about new products and whats going on in the payments industry by subscribing to the Neural Payments newsletter and blog. We'll notify you when we're launching new products, provide deep insight into the world of payments technology and so much more.